Instead of $15,000, Erica receives only about $10,500 in total. Erica’s employer withholds Federal, state and local taxes as applicable from her payments. Here is an illustration of the impact of tax gross-up: Without Gross-UpĮrica is set to receive a $5000 bonus and a $10,000 lump sum toward her moving costs. This process ensures that the employee gets the full, expected relocation benefit. Gross-up is an additional payment from the employer to cover the extra taxes due on the relocation benefits. To help persuade employees to relocate and create a more satisfactory relocation experience, most employers “gross-up” the relocation benefits they offer to employees to offset the additional tax due. Obviously, this is not a formula for happy employees! The relocation assistance and bonus Erica expected turned out to be much less than she expected (and perhaps negotiated).

#Are moving expenses tax deductible 2022 plus

Erica’s W-2 income for the year would be $90,000 ($75,000 salary, plus bonus and lump sum.) She would owe Federal, state (and sometimes local) taxes on the bonus and lump sum as ordinary income. While she is not getting a raise, her employer gave her a $5000 bonus and a $10,000 lump sum to defray her moving costs. She has accepted a different position with the company in Dallas at the same $75,000 salary. Erica currently works for Blue Sky Company in Cleveland and earns $75,000 annually.

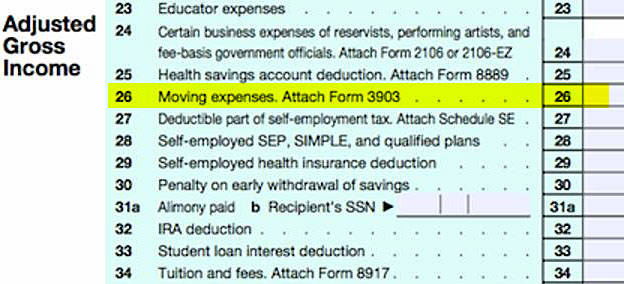

The specific tax impact on a relocating employee is a function of his or her tax bracket and place of residence, but the amount an employer pays in relocation expenses, whether directly or on the employee’s behalf, is added to the employee’s W-2 for the year. This legislation took effect for the 2017 tax year and is scheduled to sunset in 2026. These deductions and exclusions are no longer permitted, except for active duty armed forces personnel. This includes household goods transportation, temporary living expenses, miscellaneous allowances, lump sum payments and more.īefore Congress enacted the Tax Cuts and Jobs Act of 2017, the IRS permitted taxpayers to deduct certain moving expenses and exclude employer reimbursements for qualified moving expenses. The short answer is “yes.” Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

0 kommentar(er)

0 kommentar(er)